In the annals of financial history, Silver Thursday stands out as a dramatic flashpoint in one of the most notorious commodity market collapses. On March 27, 1980, the silver market reached a crisis peak, as weeks of falling prices culminated in panic selling and financial turmoil. At the center of the storm were two wealthy brothers, Nelson Bunker Hunt and William Herbert Hunt, whose massive bets on silver had helped drive prices to unprecedented highs, and whose unraveling positions would bring the market to its knees.

The Hunt Brothers and Their Silver Ambition

Nelson Bunker Hunt and William Herbert Hunt were heirs to a vast oil fortune, but their ambitions extended beyond the oil fields. In the 1970s, the Hunt brothers turned their attention to silver. They believed that the U.S. dollar was on the verge of devaluation due to rampant inflation and that precious metals, particularly silver, would serve as a stable store of value.

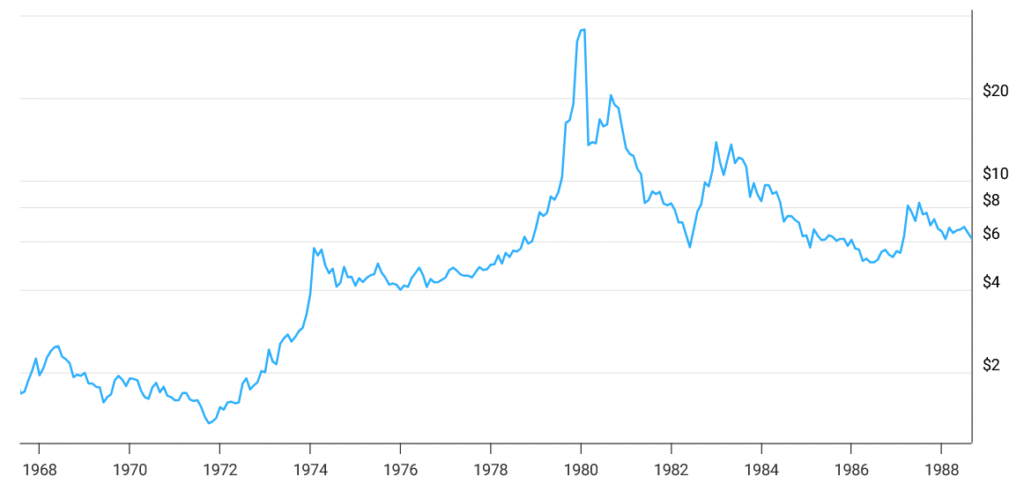

Starting in the early 1970s, the Hunt brothers began to accumulate vast quantities of silver. By early 1980, the Hunts and their associates controlled over 100 million ounces of silver, about a third of the world’s non-government supply. Their buying spree, which included both physical silver and futures contracts, drove the price of silver from around $6 per ounce in early 1979 to a peak of $49.45 per ounce in January 1980.

The Market Responds

The dramatic rise in silver prices did not go unnoticed. The Hunts’ massive purchases distorted the market, creating a speculative bubble. Other traders, noticing the skyrocketing prices, also jumped into the silver market, further accelerating the rally.

However, the meteoric rise sparked growing concern among market regulators and participants. Beginning in January 1980, the Commodity Futures Trading Commission (CFTC) and the major commodities exchanges, particularly the Commodity Exchange, Inc. (COMEX), implemented emergency measures. These included sharply raising margin requirements, the amount of collateral required to maintain positions, and imposing position limits to prevent any single entity from exerting excessive influence over the market.

The Bubble Bursts

These regulatory actions had a profound effect. As margin requirements increased, the Hunt brothers and other speculators struggled to meet their financial obligations. Silver prices, which had peaked in January 1980, began a steady decline in the following weeks as panic and profit-taking set in.

By late March, the situation had grown dire. On March 27, 1980, dubbed Silver Thursday, the crisis reached its most dramatic point. The Hunts were unable to meet a significant margin call, triggering a wave of forced liquidations and sending silver prices into a steep, accelerated drop. The sharp fall that day sent shockwaves through financial markets. Many investors who had followed the Hunts’ lead suffered substantial losses, and several brokerage firms were pushed to the brink of insolvency.

In response, the Federal Reserve helped orchestrate emergency loans to stabilize the financial system, underscoring the systemic risks posed by speculative excess and concentrated positions.

The Aftermath

Silver Thursday became a cautionary tale about the dangers of unchecked speculation and market manipulation. The Hunt brothers were widely believed to be attempting to corner the silver market, though they claimed their purchases were a hedge against inflation.

Regardless of intent, their strategy failed. In the years that followed, the brothers faced significant financial and legal repercussions. In 1989, a federal court ruled that they had attempted to manipulate the silver market. They were fined, banned from trading commodities, and forced to liquidate substantial assets. Nelson Bunker Hunt filed for personal bankruptcy in 1988.

The crisis also served as a wake-up call for regulators. The CFTC and exchanges strengthened their surveillance, enforcement mechanisms, and rules on market concentration and speculation, highlighting the vital role of regulatory frameworks in preserving market integrity and protecting investors.