Precious metals are often seen as safe-haven assets, gold in particular tends to attract investors during periods of uncertainty. But how do fluctuations in metal prices influence major currencies?

The Case of Gold

The aim of this study is straightforward: to identify which currency pairs have been most and least correlated with daily changes in gold prices between 2000 and 2025.

We focus on:

- The most actively traded major pairs: EUR-USD, GBP-USD, USD-JPY, USD-CHF, USD-CAD, AUD-USD.

- Two special cases: USD-ZAR (South Africa, where precious metals play a key economic role and the currency is often sensitive to commodity prices) and USD-SGD (Singapore, whose managed exchange rate makes it an interesting benchmark).

To ensure comparability, all series were harmonized so that the direction of price changes is consistent across pairs and with XAU-USD. In practice, for pairs quoted as USD-XXX, the sign was inverted so that the interpretation matches that of XXX-USD.

Results (2000–2025)

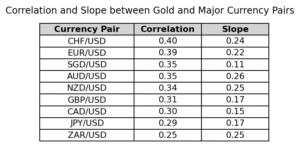

We computed Pearson correlations between daily gold returns and each currency pair, along with the regression slope.

How to Read the Table

- The Pearson correlation measures the strength and direction of the linear relationship between daily changes in gold and the currency pair. A value close to 1 means they tend to move together; a value near 0 indicates little or no linear relationship.

- The slope reflects the average sensitivity: if gold rises by 1% in a day, how much does the currency pair typically move the same day? For example, with EUR-USD (slope ≈ 0.216), a 1% increase in gold corresponds on average to a +0.216% rise in the pair over the full sample.

The Most and Least Correlated

- Most correlated: CHF and EUR (≈ 0.40–0.39)

- Least correlated: ZAR and JPY (≈ 0.25–0.29)

The South African rand (ZAR) illustrates an important nuance: its correlation with gold is relatively low, but its regression slope is high, meaning that when it does react, the move is usually large. This reflects the currency’s high volatility: large, isolated swings can boost the average slope without increasing overall correlation. In other words, low correlation doesn’t mean no reaction.

Limitations and Key Takeaways

Weak to Moderate Correlations

These coefficients show that a substantial portion of daily currency movements remains independent of gold. The relationship is far from decisive on its own.

For context, some asset classes are known to be tightly linked: gold and silver often show correlations above 0.8; the S&P 500 and Nasdaq indices typically range between 0.9 and 0.95; even two safe-haven currencies like the Japanese yen (JPY) and the Swiss franc (CHF) frequently exceed 0.7.

Against these benchmarks, the 0.25–0.40 correlations observed between gold and major currencies appear modest. They suggest gold may influence exchange rates, but it explains only a small fraction of their daily movements.

The Role of the U.S. Dollar

Since all pairs are quoted against the U.S. dollar, part of the co-movement likely reflects the dollar’s own influence rather than a direct link between gold and the other currency. Disentangling those effects is tricky and highlights the central role of the USD in any analysis involving commodities and FX.

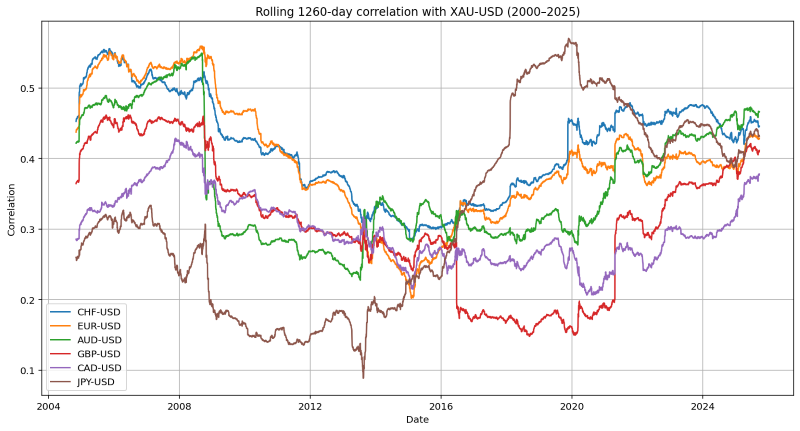

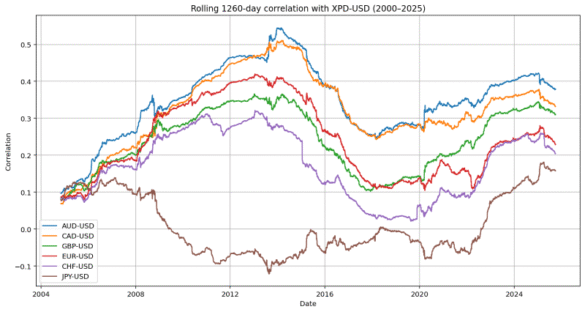

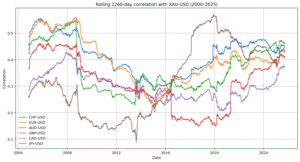

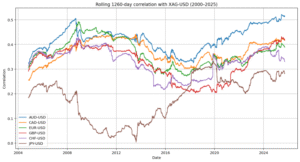

An Unstable Relationship Over Time

Rolling-window correlations reveal strong variability over the years: some periods show a relatively tight link between gold and currencies, others almost none, with spikes around major financial crises. In short, the relationship is not stable.

The chart illustrates these regime shifts clearly. For instance, the yen (JPY/USD) experienced a sharp structural change in the mid-2000s, as its correlation with gold flipped direction, reflecting a shift in the yen’s international role. More broadly, all major currencies show turning points: phases when gold plays a more influential role in FX markets, followed by phases when the connection weakens sharply.

This instability means that a single hedge ratio or fixed model quickly becomes obsolete when market regimes change. The gold–FX correlation is not only modest in magnitude; it is also unstable over time, which further limits its practical use.

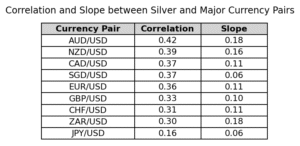

What About Silver?

Applying the same methodology to daily silver price changes (XAG-USD) from 2000 to 2025 yields similarly weak-to-moderate correlations, but with one notable case: AUD emerges as the most correlated pair (≈ 0.416).

The regression slope confirms this link: a 1% rise in silver corresponds on average to +0.176% for AUD-USD. This fits Australia’s profile as a major precious-metal producer and reinforces its reputation as a “commodity currency”, even more clearly for silver than for gold.

The rolling 5-year correlation chart supports this view: the AUD’s correlation with silver is not constant but shows a gradual strengthening over time, whereas the link with gold was less pronounced.Conversely, the JPY stands out for its persistently weak and unstable correlation, confirming that it reacts very little to precious-metal moves.

In short, the case of silver particularly highlights the distinctive role of the AUD, even more than for gold, and emphasizes the non-stationarity of these relationships over time.

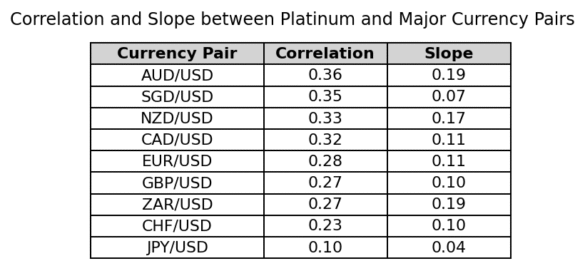

Turning to Platinum and Palladium

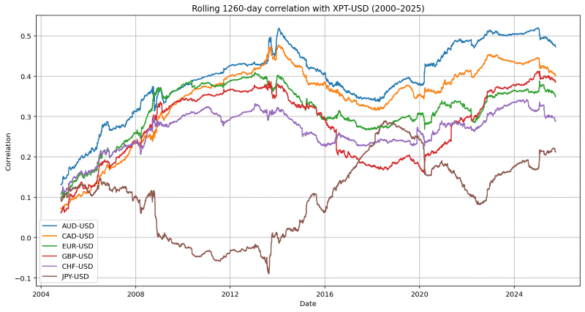

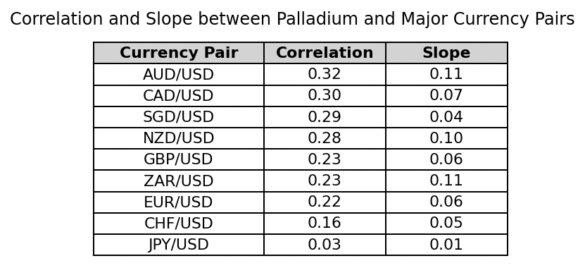

Extending the same analysis to platinum and palladium (2000–2025) reveals even weaker correlations than for gold or silver. For platinum, the AUD again leads (≈ 0.36), followed by other commodity-linked currencies such as the NZD and CAD. The ZAR also shows notable sensitivity (slope ≈ 0.19), consistent with South Africa’s dominant role in global platinum production. For palladium, correlations are lower still, peaking around 0.32 for the AUD, and very low for the EUR (≈ 0.22) or JPY (near zero).

Rolling correlations confirm the pattern: the AUD maintains a positive but fluctuating relationship, while most other currencies exhibit weak and unstable links. Overall, platinum and palladium extend the same logic observed for gold and especially silver.

Conclusion

This analysis highlights gold’s unique status among precious metals. Its strongest links are with defensive currencies such as the Swiss franc and the euro. For silver, platinum, and palladium, the relationships are stronger with commodity currencies, particularly the Australian dollar, which lives up to its reputation as a metal proxy. The Japanese yen remains by far the least correlated currency, regardless of the metal considered. Overall, correlations are modest and unstable.

In practice, for retail traders, these relationships are too weak and too inconsistent to serve as standalone signals. For professionals, however, they can provide useful guidance for risk management and help calibrate average hedge ratios over time.